How to Quickly Check Solana Memecoin Contracts with Bots to Avoid Rugs & Scams

Navigating the world of cryptocurrency, especially with the rise of meme coins, requires vigilance and thorough research to avoid falling victim to scams. In this article, we’ll explore the key strategies for identifying red flags in Solana memecoin contracts. By understanding these warning signs, you can better protect your investments from rug pulls and other fraudulent activities.

10 Key Warning Signs of Token Scamming

- Unnatural Chart Patterns

One of the most telling signs of a potential scam is unnatural chart patterns. If you notice a continuous upward movement in the token’s price without any sell orders or red candles, this could be a “honeypot” scam. In such schemes, buyers are unable to sell their tokens, leaving them trapped while the price appears to skyrocket. This manipulation creates a false sense of security, encouraging more investments that will ultimately be lost.

2. Steady Volume with No Decline

Another significant red flag is a steady trading volume with no red volume candles over a short period. This pattern suggests that the trading activity might be manipulated, with restricted selling or artificial buying. Scammers often use this tactic to maintain the appearance of a healthy market, tricking investors into thinking that the token is stable.

Pro Tip: To analyze these patterns more effectively, use a reliable bot like DevSellingBot on Telegram. (Link https://t.me/is_dev_selling_bot)

By pasting the contract address into the bot, you can quickly assess whether there are potential issues with the token, such as unnatural volume or other suspicious activities.

3. Mint Authority:

Before investing in any token, always check the status of the mint authority. If the mint authority is enabled, the creator of the token can mint additional tokens at any time. This devalues your investment, as more tokens are introduced into circulation, often leading to a sharp decline in the token’s price. Ensure that the mint authority is disabled to prevent the creators from flooding the market with more tokens.

4. Liquidity Pool (LP) Status:

The liquidity pool is critical to a token’s stability. When evaluating a new token, check whether the liquidity pool is 100% burnt or locked. If it isn’t, the creators have the ability to withdraw the liquidity, rendering the token worthless. This tactic is a common method for executing a rug pull, where the developers vanish with the liquidity, leaving investors with worthless tokens.

5. Freezable Functions:

Examine the token’s smart contract to see if it includes any freezable functions. These functions allow the creators to freeze trading or other actions, which can prevent you from selling your tokens or executing other transactions. By default, these functions should be set to “no.” If they are enabled, your investment is at risk, as the creators could freeze your assets at any time.

6. Holder Distribution:

The distribution of tokens among holders can also indicate potential risks. Use tools like DevSellingBot to analyze whether the top 10 holders control too much of the token supply. If a small group holds a significant portion of the supply, they can easily manipulate the market by dumping their tokens, causing the price to plummet. A healthy distribution is essential for the long-term stability of a token.

7. Social Networks:

A project’s social presence can provide valuable insights into its legitimacy. Check whether the project has active and legitimate banners on platforms like DexScreener. Additionally, verify that the project has a functioning website, an active Telegram group, and a Twitter account. The developer’s activity in these channels is crucial; they should regularly post updates and engage with the community. A lack of communication or transparency from the developers is a red flag that should not be ignored.

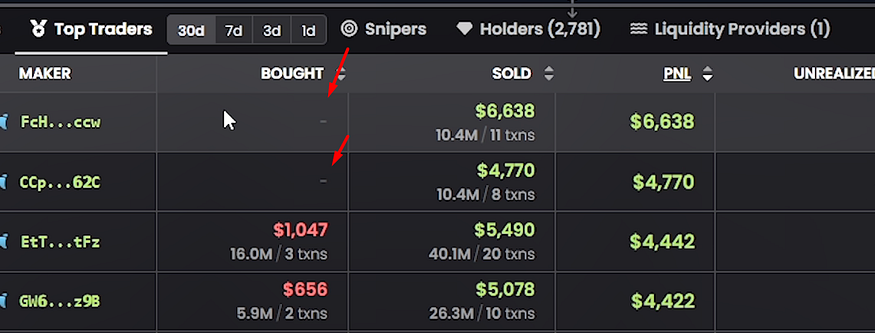

8. Developer Greed:

Monitoring the financial behavior of developers can reveal a lot about the integrity of a project. If you notice that developers are withdrawing large sums of money from the project, it could be a sign of greed and impending fraud. This behavior is particularly concerning if the top trading section doesn’t show corresponding purchase transactions. Such discrepancies suggest that the developers may be siphoning off funds rather than reinvesting in the project.

9. Lack of Advertising:

A legitimate and promising project typically invests in advertising and promotion. If the project isn’t buying ads, promoting through crypto influencers, or securing rankings on platforms like DEXTools or DexScreener, it’s a bad sign. The absence of marketing efforts indicates a lack of commitment to growing the project and could suggest that the creators are not interested in its long-term success.

10. Use Stop-Loss Bots:

To protect your investment from total loss, it’s essential to use stop-loss bots like Trojan Access the bot and ( click here ). These bots automatically execute a stop-loss order at a predefined percentage loss, such as 35%. This strategy allows you to minimize your losses and exit a failing investment before it becomes worthless. For a detailed guide on how to use Trojan and other similar bots, you can refer to additional resources available online.

Official links

- Official Trojan bot

- Signals from the Defi market 🎲 Gamble /💎Dyor https://t.me/WOOF_CALL

Conclusion

In the fast-paced and often volatile world of meme coins, especially on the Solana network, it’s crucial to conduct thorough research and be aware of the potential risks. By following these ten key warning signs, you can better protect yourself from scams and make more informed investment decisions. Always use the available tools, such as bots and analysis platforms, to safeguard your investments and stay ahead of potential threats in the crypto market.

Post Comment